RICHMOND, VA – May 23, 2005 – Matrix Capital Markets Group, Inc. announced today the successful closing of RPF Oil Company’s (“RPF” or the “Company”) acquisition of 44 BP retail and wholesale fuel assets in the Greater Detroit market.

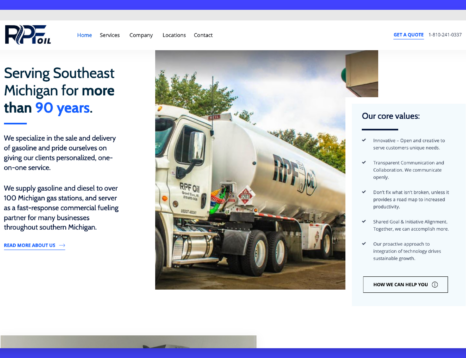

Matrix provided acquisition and capital raising advisory services to consummate the transaction. Tom Kelso, Managing Director and Head of the Energy and Multi-Site Retail Group at Matrix, and Spencer Cavalier, Vice President, managed this transaction. Based in Grand Blanc, Michigan, RPF has been distributing and marketing motor fuels in the Greater Detroit market since 1933 and RPF has been a distributor for BP and BP Amoco since 1985. This is RPF’s first major transaction in support of the Company’s strategic plan to grow its distribution business.

"We greatly appreciate the excellent advice and transaction execution provided by Matrix. We could not have been successful in our efforts to acquire the BP Assets without the help of the Matrix team of professionals."

- Dan Fleckenstein, Vice President and Head of Acquisitions for RPF

RPF’s successful acquisition makes the Company one of the largest BP branded jobbers in Michigan, with nearly 100 million gallons of motor fuels supplied annually.

The 44 retail and wholesale fuel assets acquired are comprised of 4 company owned, company operated sites (COCOs), 6 company owned, commissioned marketer sites (COCMs), 9 company owned, dealer operated sites (CODOs), and 25 dealer owned, dealer operated (DODOs) sites. At the closing, RPF assigned the purchase of the 4 COCO sites to one of its leading dealers, Auto City Services, Inc. (“ACS”), and entered into a long term supply agreement for those and other additional ACS stores.

Matrix’s Energy and Multi-Site Retail Group is recognized as the national leader in providing transaction advisory services to companies in the energy and multi-site retail sectors. Team members are dedicated to these sectors and draw upon complementary experiences to provide advisory services to complete sophisticated merger and acquisition transactions, private debt and equity raises, corporate restructurings, and corporate valuation and long term planning engagements.