On June 24, 2025, Brent crude slid 3.5% to ~$68 / bbl after Israel and Iran agreed to a ceasefire. WTI futures fell in tandem as markets shed risk premiums amid easing Middle East tensions.

TL;DR: A truce between Israel and Iran drove Brent below $70 / bbl, narrowing the Brent-WTI spread. Midwest wholesale fuel rates fell by 4 ¢/gal. Station owners should evaluate forward purchasing, dynamic pricing and flexible supply deals to protect margins.

Background and Market Reaction

Key Terms of the Ceasefire Agreement

• Iran ceased hostilities immediately; Israel paused operations within 12 hours.

• Both sides agreed to a full 12-day conflict halt after 24 hours of compliance.

Immediate Price Response

• Brent retreated to its lowest level in over a week; WTI fell below $65 / bbl.

• U.S. crude stocks surged by 9.5 MMbbl, relieving supply-security concerns.

• The Brent-WTI spread narrowed to under $3 / bbl.

Context of 2025 Volatility

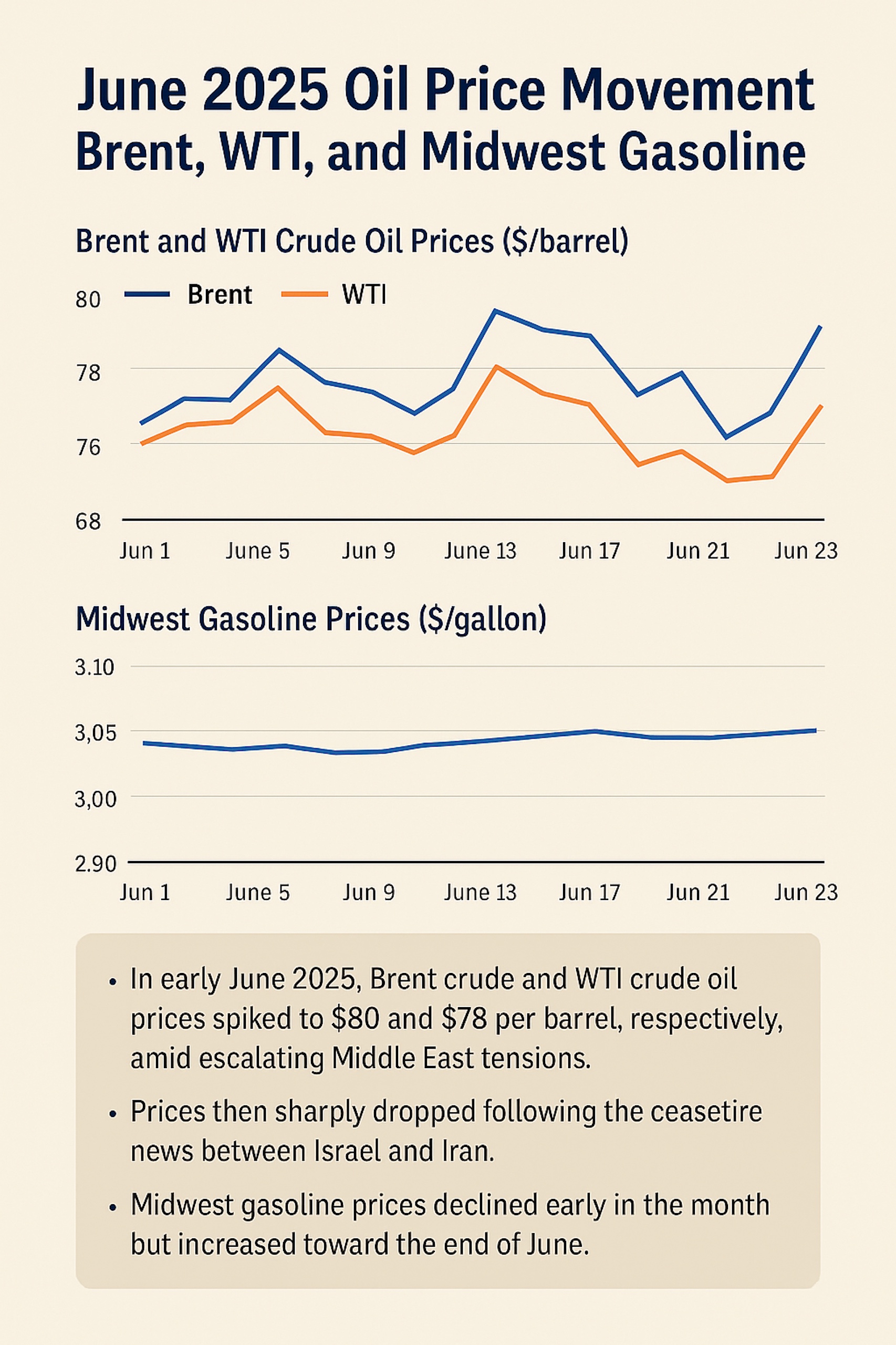

Prices spiked near $80 / bbl mid-week on rising tensions and OPEC output cuts. Still, OPEC’s ~2.5 MMb/d spare capacity and steady non-OPEC flows capped any sustained rally.

Middle East Supply Dynamics and Strategic Risks Iran’s OPEC Role

Producing ~3.5 MMb/d—over 12% of OPEC’s total—Iran’s pre-ceasefire outages had been priced into markets.

Strait of Hormuz Vulnerabilities

Nearly 18–19 MMb/d flow through this chokepoint—about one-fifth of global supply. Any disruption could trigger acute shortages and price surges.

OPEC Output Increases

OPEC added 400 Kb/d in May. The IEA forecasts 1.2 MMb/d global demand growth for 2025, comfortably met by current supply.

Price Trends and Fundamental Balances

Post-Ceasefire Movement

Brent settled at $68 / bbl; WTI dipped below $65. U.S. Gulf Coast inventories rose, shrinking the regional differential.

OPEC & IEA Stock Reports

Both agencies report rising global stocks. OECD commercial reserves climbed by 5 MMbbl in May, underpinning a bearish bias.

Wholesale Fuel Pricing in the Midwest

Wholesaler rack rates fell by 4 ¢/gal. Michigan distributors reference lower terminal prices, intensifying local competition and margin pressure.

Implications for Midwest Gas Station Owners

Retail Pass-Through Dynamics

Retail prices lag crude by 7–10 days. AAA data shows a $3.28/gal regional average—down 6 ¢ W/W. Stations should monitor lag times to optimize pricing.

Diesel Price Pressures

Midwest diesel averages $3.62/gal. Crude relief lowers fleet costs, but volatility from OPEC, refinery runs and global demand remains high. Operators should model conservatively.

Strategic Responses and Operational Guidance

Inventory & Dynamic Pricing

Forward purchasing locks in lower costs; automated pump pricing synchronizes margins with rack shifts.

Branding Partnerships

Consider a national fuel brand for marketing support and loyalty programs. RPF Oil’s turnkey rebranding includes site audits, materials and co-op marketing funds.

Opportunities for Buyers & Investors

Acquisitions & Leasing

Lower feedstock costs enhance profit forecasts and valuations. Buyers should stress-test models for conflict-flare scenarios.

Financing Considerations

Lenders adjust collateral values to margin volatility. Robust cash-flow models covering diesel and wholesale trends strengthen debt proposals.

Partnering with RPF Oil

Long-term supply agreements reduce exposure to rack-rate swings. RPF Oil delivers transparent pricing, consistent fuel quality and dedicated support.

Contact RPF Oil Company to explore supply agreements, branding partnerships and pricing strategies.

Written by RPF Market Insights Team

Get Updates & The Latest News from RPF Oil Company

Stay updated on our latest expansions and community initiatives. Don’t forget to check out the RPF Oil News & Media Hub for more news, insights, and updates about our company.

Frequently Asked Questions

By removing geopolitical risk, it lowers Brent and WTI risk premiums—pushing prices down and easing supply pressures.

Typically within 7–10 days, depending on inventories, distribution cycles and local competition.

Diesel may see short-term relief, but OPEC output decisions, refinery runs and global demand could renew volatility.

Use forward purchasing, dynamic pricing, and suppliers who offer price-watch programs like RPF Oil to protect margins.

We provide transparent wholesale pricing, dependable contracts and turnkey rebranding services to enhance resilience. Contact our team of experts today.